As published in Toledo Business Journal - November 1, 2012

Substation at Chrysler Group LLC Toledo Jeep assembly plant

Electricity cost advantage positions region

There has been a perception from the past that electricity costs in northwest Ohio were among the highest in the state and in the country. Some have held the belief that the region was at a competitive disadvantage in attracting new manufacturing companies that have high electricity usage.

The current reality concerning industrial electricity rates for manufacturing and industrial companies in the region is far different than years past.

Industrial electricity rate advantage

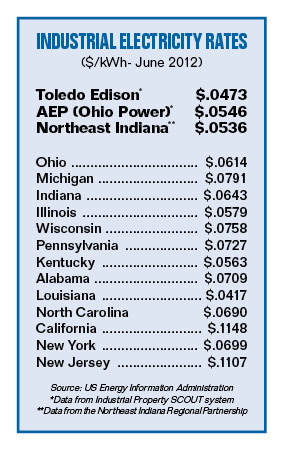

Today, utility companies servicing northwest Ohio are positioned with an advantage in industrial electricity rates. While this is not the case for residential and commercial electricity rates, a comparison of industrial rates from electric utility companies in Ohio, Michigan, Indiana, and other states begins to show the current rate advantage for northwest Ohio utilities.

Current utility rates and other data for industrial labor costs, transportation costs, environmental information, tax rates, demographic data, economic development incentives, area industrial suppliers, and much more can be found through a new regional economic development tool called Industrial Property SCOUT.

The SCOUT system enables industrial site selection professionals and business decision-makers to easily obtain a range of current information about doing business in the region. This information is needed for site selection analyses and decisions. It can be found at http://www.toledobiz.com/property_scout.html

Toledo Business Journal is disclosing to readers that it is involved in the development and operations of the new SCOUT system.

Utility pricing data from the system shows average industrial electricity rates from Toledo Edison at $0.0473 per kWh and from American Electric Power’s subsidiary, Ohio Power Company, at $0.0546 per kWh based on information from June 2012. This data is the average industrial electricity cost experienced by all industrial customers of each utility. It includes the pricing impact of volume usage and load factors that impact peak rates. It also includes customers’ actual generation costs even if an alternative utility is the supplier. It is important to note that these average rates can be skewed by the mix of customers for each utility. For example, a large percentage of very high volume customers with favorable load factors and low peak usage costs will lower the average industrial rate for a utility company.

The most recent data available through this system is from June 2012. There is currently a time lag in order to obtain utility usage and cost information, process it through the system, and publish it to the SCOUT site. A review with Toledo Edison and other utility industry authorities confirms that the data from the SCOUT system reflects the average of the actual rates being provided to industrial customers.

By comparison, using the same time frame, the average industrial electricity rate in Michigan during this period is $0.0791 per kWh and in Indiana it is $0.0643 per kWh, according to the US Energy Information Administration. The attached chart provides a comparison of industrial electricity rates for a much broader geographic area.

Industrial electricity rates from Toledo Edison and AEP’s Ohio Power Company and other utilities in the region are significantly lower than other Midwestern utilities. They are lower than utilities in many other states around the country. Industrial electricity rates in northwest Ohio are now competitive with low-cost utilities around the country.

Outdated data

Utility cost is an important factor for many industrial companies considering new development projects. Unfortunately, there is a significant amount of outdated and erroneous data that companies obtain while assessing alternative site options.

Many business professionals do analysis in advance to screen and eliminate potential competing sites. This is done in order to reduce the number of sites to a manageable level and to determine the leading alternatives. Professionals doing this analysis often obtain web-based data from economic development sites and other locations and many do not contact area officials until they have narrowed the alternative sites later in the process.

Outdated data and outdated perceptions can eliminate sites in northwest Ohio and southeast Michigan before local officials can get a chance to learn about a potential project and then provide input.

Indiana competition

A current example concerning utility cost issues involves information from the Northeast Indiana Regional Partnership. There is strong competition from development officials in Indiana to win new investment and jobs. Companies formerly located in northwest Ohio and southeast Michigan have moved their facilities and jobs to Indiana in order to obtain development incentives being offered. Indiana has been in competition with northwest Ohio for a number of major projects. Alternative sites in both states have been considered.

The Northeast Indiana Regional Partnership has been representing for some time that their region has a major advantage in terms of industrial electricity rates. They are advising prospective clients and others that an average industrial rate for electricity in their area is $0.0536 per kWh. By contrast, they advise that an average industrial rate for electricity in Ohio is $0.0636 per kWh or 19% higher.

The reality is that the industrial electricity data being used by the Northeast Indiana Regional Partnership does not present an accurate picture of comparable rates in northwest Ohio. Industrial electricity rates in northwest Ohio are now lower than Indiana, including utilities in northeast Indiana.

Northwest Ohio is not at a 19-plus% industrial electricity cost disadvantage to sites in northeast Indiana. Companies locating or expanding in northwest Ohio will not incur a 19-plus% penalty on industrial electricity rates compared to alternative sites in northeast Indiana.

Instead, both Toledo Edison and AEP’s Ohio Power Company subsidiary and other utilities serving northwest Ohio offer lower or competitive industrial electricity rates compared to utilities in northeast Indiana.

Understanding current industrial electricity rate data and the advantage that northwest Ohio utility companies are providing offers new economic development marketing opportunities for the region. Making this current data available to companies considering new investment offers a chance to win new industrial projects that may not have considered northwest Ohio based on past industrial electricity rates.

Providing current and accurate data needed by site selection professionals and decision-makers at companies assessing new sites will assist in confronting outdated and erroneous information that places the region at a competitive disadvantage. In order to challenge and change past perceptions that are no longer accurate, current data and quality information are a critical weapon.

Changing perceptions that are no longer the reality held by some industrial site selectors, such as industrial utility rate perceptions, will need to start with business professionals located in the region. It will then be necessary to include this information in marketing efforts targeted to business decision-makers outside the area who are involved in selecting sites for industrial projects.